Table of Content

- Can I get a COE as the spouse of a Veteran?

- Can I use a COE I used before?

- What is a rate lock?

- VA home loan types

- Connect with us today at866-367-8600 or317-558-6160 to learn more about our specific mortgages

- Can I get a Certificate of Eligibility for a VA direct or VA-backed home loan?

- How do you lock in your VA loan interest rate?

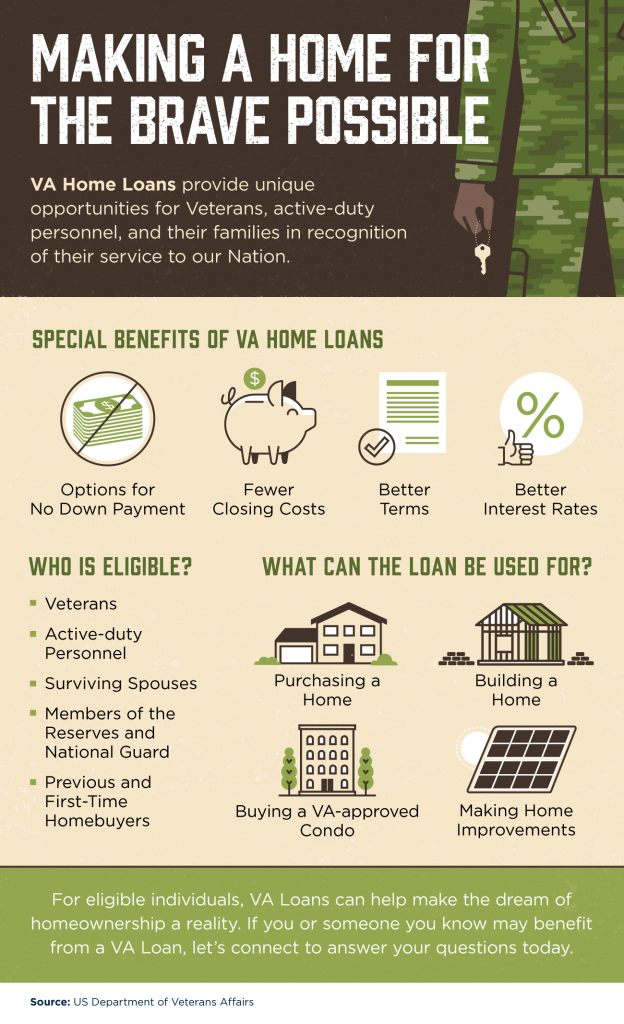

Learn more about the different programs, and find out if you can get a Certificate of Eligibility for a loan that meets your needs. Currently I am in two separate repayment programs for those with defaulted student loans. I simply cannot afford the over $800 monthly payment requested, and thus am working to get this reduced. My understanding however, is that ANY defaulted government loan prevents the awarding of another loan for the purposes of purchasing a home. Can you please provide clarity or additional information regarding this. Remember, you’ll go through a private bank, mortgage company, or credit union—not through us—to get your loan.

I’m paying my mortgage next year, so everybody is welcome to celebrate it, folks. Managing your expenses and income is especially crucial today. If you can’t manage your money, it will manage your life.

Can I get a COE as the spouse of a Veteran?

The VA backs the mortgages, making them a lower risk for lenders. Estimate closing costs, down payments and taxes with our calculators. Calculate monthly payments based on a 15- or 30-year term loan to decide which is best for you. Lock your current rate for 365-days, one-time float-down option, and ability to change loan products at current market rates. You can also use the resources below to learn more about the VA home loan program and the home-buying process. You can ask your real estate agent to provide the lender with valid sales data showing the property is worth more than its appraised price.

So, we must pay attention to our expenses and earnings. I think that VA and FHA can work well if you have the right credit union handling it. Member-owned credit unions are the captain's balls, imo, they used to send us profit sharing checks at the end of the year, based on our loan size. For a mortgage, it was about a $1500/year, definitely nontrivial. Back when the market tanked and half the homes sold were short sales.

Can I use a COE I used before?

IIRC it's not a large monthly amount but it adds up. We Refinanced recently with a new FHA loan at lower rate and dropped our monthly payment by $500. It's very difficult to re-fi into a conventional loan with no PMI, due to our LLC that owns rental properties.

For more information on VA's minimum property requirements, please watch this video. A real estate agent can help you navigate the home buying process. It is important to select a real estate agent that you are comfortable working with, and that will work diligently to help you find the right home.

What is a rate lock?

Your closing may be held at a title company, escrow office, or attorney’s office. Be prepared to sign a lot of documents—and be sure to take the time to read everything before you sign. Pay the difference between the appraised price and the sales price. To do this, you’ll need to pay this cost at closing.

Closings may occur at a title company, escrow office, or attorney’s office depending on your area’s laws. Expect to sign many documents including the mortgage, the note, and the deed. This can be a lengthy process but always stop to ask questions if you have any. In many instances you can negotiate with the seller to pay part or all closing costs.

VA home loan types

I did it in GA, and thought about using the remaining entitlement to offset some of the downpayment for one here in CA, but decided not to. 3 - since there are few bankers that know about that, you'll have a much harder time finding one that will give you a loan. You also stand a good chance of getting a higher interest rate because your bank options are limited. I don't want to refinance, and I'm am 99% sure that you can in fact have two VA loans at once. I am just confused on my certificate of eligibility cause it looks like it says that my entitlement is 0....

They guide me and provide best option for me. I Suggest you to contact with them if you need any information regarding loan. Other contingencies to consider are an appraised value contingency and a satisfactory home inspection contingency. Your real estate agent can advise you if these or other contingencies are typical in your real estate market. Please view this video for additional information on being pre-approved by a lender.

Get a Quote A VA approved lender; Not endorsed or sponsored by the Dept. of Veterans Affairs or any government agency. We’ve compiled some of the most common mortgage rate questions below so that you can make more informed decisions. Answer a few questions below to speak with a specialist about what your military service has earned you. If credit is a concern, Veterans United offers a no obligation credit consulting service to help get you on the road to preapproval. I bought my current home with a VA Loan It has many advantages and it is a benefit worth exploring.

But to be sure you need to contact a lender that specializes in VA loans. Since it is a bank that will loan you the money and not the VA, I am not quite sure how they can tell you that you will not have to contribute money. I have never known anyone who had 2 VA loans concurrently. The VA told me over the phone today I can get another loan in the amount of $144k-$273k. Without contributing any additional money, And that anything above $273 I would have to contribute money.

In short, a VA loan gives you the best of both worlds. You enjoy your benefit, but have the convenience and speed of working with your chosen lender. With a VA loan, you can buy immediately, rather than years of saving for a down payment. With a VA loan, you also avoid steep mortgage insurance fees. At 5 percent down, private mortgage insurance costs $150 per month on a $250,000 home, according to PMI provider MGIC.

No comments:

Post a Comment